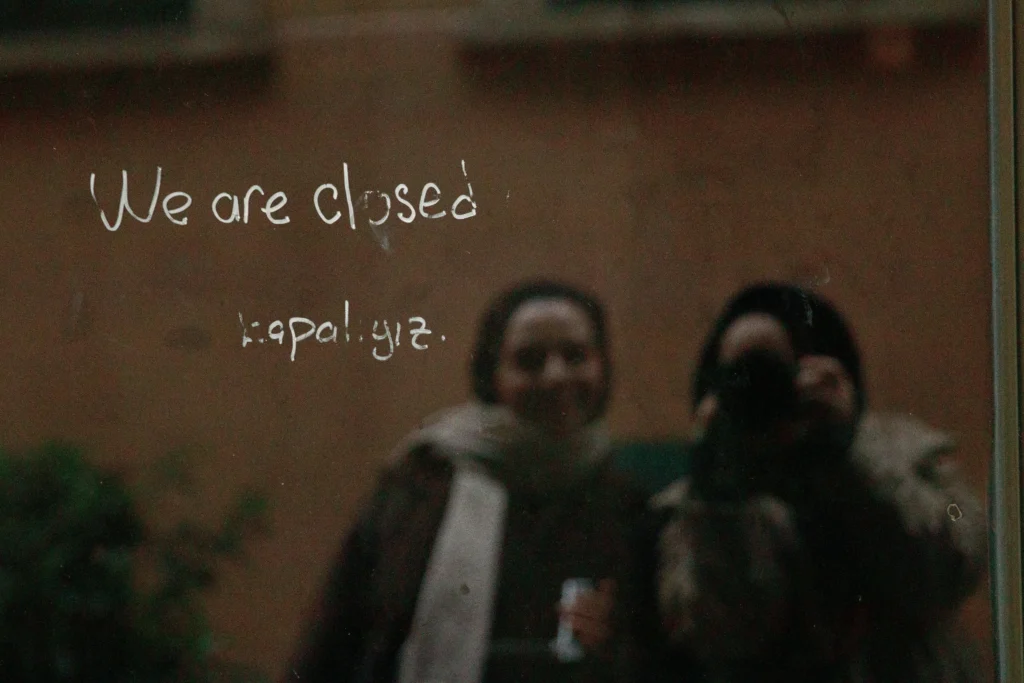

Imagine this: your business faces a fire, a storm, or a cyberattack that halts operations for days—or even weeks. Without a plan, lost revenue, ongoing expenses, and delayed recovery can put your company in serious jeopardy. This is where business interruption insurance becomes a lifeline.

In 2026, with evolving risks—from climate-related disasters to cyberattacks—business interruption coverage is no longer optional. For startups, small businesses, and even established companies, it provides financial protection and peace of mind when unexpected events threaten daily operations.

What Is Business Interruption Insurance?

Business interruption insurance, sometimes called business income insurance, helps cover lost income and operational expenses if your business cannot operate due to a covered event. Unlike standard property insurance, which replaces damaged assets, business interruption insurance ensures that your cash flow continues while your business recovers.

Typical expenses covered include:

- Rent or mortgage payments

- Employee wages

- Utilities and operational costs

- Loan payments

- Temporary relocation costs

Essentially, it helps your business stay afloat, even when normal operations are disrupted.

Why Business Interruption Insurance Matters in 2026

Modern businesses face a variety of risks that make this coverage crucial:

- Natural Disasters: Storms, floods, fires, earthquakes, and wildfires are increasing in frequency and severity. Even a short closure can be financially devastating.

- Cyber Incidents: Ransomware, hacking, or system failures can halt operations for days or weeks, resulting in lost revenue.

- Supply Chain Disruptions: Global supply chain challenges can prevent your business from delivering products or services, creating operational gaps.

- Pandemic-Style Disruptions: Even post-2020, sudden health crises or government-mandated closures can temporarily shut down businesses.

Business interruption insurance ensures that, no matter the disruption, your business can survive and recover.

How Business Interruption Insurance Works

Here’s a simple example:

- Your storefront experiences fire damage.

- You close temporarily to repair the premises.

- Business interruption insurance covers lost income, employee wages, and other operational costs while your business is closed.

- Once repairs are complete, your business resumes normal operations without financial collapse.

Most policies require that the interruption is caused by a covered event, so it’s important to understand the details of your policy. Some events, like floods or earthquakes, may require additional coverage.

What Business Interruption Insurance Typically Covers

Business interruption insurance generally covers:

- Lost revenue: The income your business would have earned during downtime.

- Operating expenses: Rent, utilities, payroll, and loan payments.

- Temporary relocation costs: If your operations must move to a temporary location.

- Supplier and customer dependencies: Some policies cover losses if your supply chain is disrupted.

- Civil authority closures: When local governments mandate closures, certain policies cover lost income.

Choosing the Right Policy in 2026

Selecting the right business interruption coverage requires careful planning:

1. Understand Your Risks

Analyze your business operations, industry, location, and digital systems. Identify potential threats—physical and digital—that could interrupt operations.

2. Estimate Your Revenue Needs

Know how much income your business needs to cover operating costs during downtime. Policies should align with these estimates to provide adequate protection.

3. Include Digital and Cyber Risks

Modern businesses rely heavily on technology. Ensure your policy accounts for cyber incidents that can halt operations.

4. Consider Extra Expenses

Temporary relocation, equipment rental, or expedited repairs may be necessary. Include these potential costs in your coverage plan.

5. Review Policy Exclusions

Check for exclusions such as floods, earthquakes, or pandemics, and consider additional coverage if needed.

Common Mistakes to Avoid

- Underestimating potential downtime: Many businesses assume recovery will be quick, but repairs, data restoration, and supply chain delays often take longer.

- Skipping digital risks: Cyberattacks are as disruptive as physical disasters, yet many policies don’t cover them automatically.

- Not updating the policy as business grows: As revenue and operations increase, coverage limits should be adjusted accordingly.

- Ignoring supply chain dependencies: Losses caused by supplier or partner interruptions may not be covered unless specifically included.

Avoiding these mistakes ensures your business interruption insurance truly protects your company.

The Real Value of Business Interruption Insurance

In 2026, business interruption insurance isn’t just about replacing lost revenue. It’s about:

- Financial stability: Keeping bills paid and employees employed even during closures.

- Business continuity: Allowing operations to resume smoothly once disruptions end.

- Peace of mind: Knowing that one unexpected event won’t cripple your company.

- Reputation protection: Avoiding the negative impact of missed deliveries, delayed services, or unmet commitments.

For businesses of all sizes, this coverage is an essential safety net.

Final Thoughts: Prepare for the Unexpected

Business interruption insurance is the bridge between disaster and recovery. In a world where natural disasters, cyber threats, and operational disruptions are increasingly common, having a safety net in place ensures your business can survive and thrive.

By understanding your risks, choosing the right policy, and regularly updating coverage, you can protect your revenue, employees, and long-term growth. In 2026, businesses that plan for the unexpected are the ones that succeed—because they don’t just survive disruptions—they recover stronger than before.