How Trump’s Tariffs Could Shape the U.S. Economy in 2026 and Boost the Stock Market

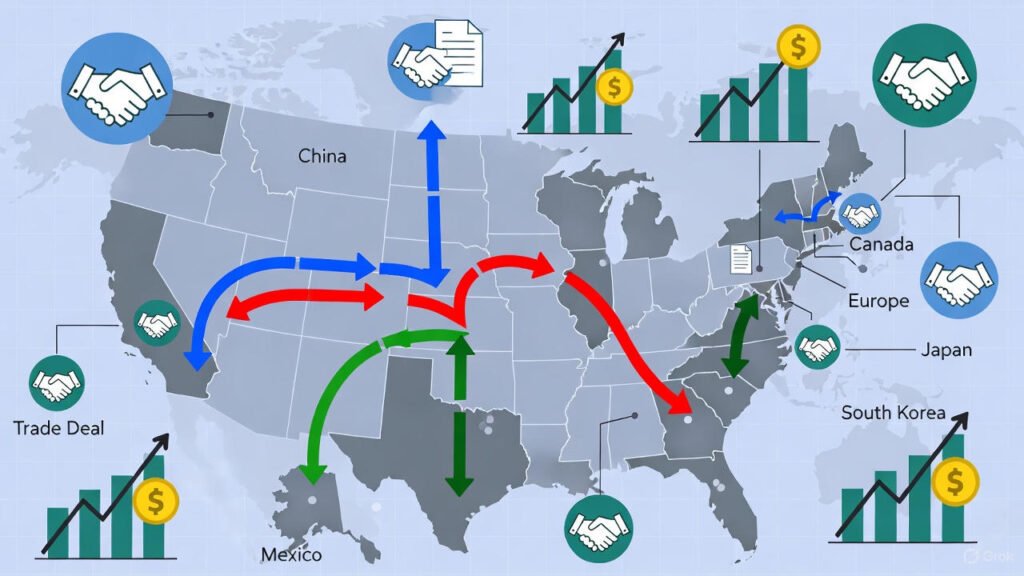

How Trump’s Tariffs Could Shape the U.S. Economy in 2026 and Boost the Stock Market As 2026 approaches, many investors and economists are contemplating the potential effects of former President Donald Trump’s tariffs on the U.S. economy and stock market. While his administration’s tariffs were designed to protect U.S. businesses and reduce trade imbalances, the lingering effects of these policies could have a lasting impact on the financial landscape. In this blog, we will dive into Trump’s tariffs in 2026 and explore how their removal or modification could boost the U.S. economy, leading to stock market growth and providing new opportunities for investors. Understanding Trump’s Tariffs and Their Impact During Trump’s presidency, the United States implemented a series of tariffs on goods from countries like China, the European Union, and other global trade partners. These tariffs were intended to protect American manufacturers and reduce the trade deficit by making foreign products more expensive for U.S. consumers. However, the tariffs also sparked trade tensions and led to retaliatory tariffs on American goods. While the long-term effects of Trump’s trade policies are still unfolding, many analysts believe that adjusting or eliminating these tariffs could provide a significant boost to the U.S. economy. But how exactly could this impact the stock market in 2026? Let’s explore the key areas where the removal or reduction of tariffs could play a major role. The Positive Effects of Reducing Tariffs 1. Lower Production Costs for U.S. Businesses One of the most significant ways that Trump’s tariffs in 2026 could impact the U.S. economy is by reducing production costs for businesses. With the removal of tariffs, companies that rely on imported goods and materials will no longer face inflated costs, which will likely improve profit margins. This cost reduction can lead to lower prices for consumers and better overall business profitability. For instance, industries like manufacturing and electronics, which depend heavily on imported raw materials and components, will benefit from tariff reductions. Companies in these sectors will be able to reduce their production expenses, which could result in increased earnings and higher stock valuations. As corporate earnings rise, stock prices are likely to follow suit, benefiting investors and fueling market growth. 2. Stimulating International Trade and Exports In addition to lowering production costs, reducing tariffs will make international trade more efficient and profitable for U.S. businesses. With fewer trade barriers, companies will be able to access foreign markets more easily, expanding their customer base and increasing revenue opportunities. For example, U.S. companies that export products to China and Europe could experience a boost in demand as tariffs on their goods are reduced. This increased trade could stimulate economic growth, especially in export-driven industries like agriculture, energy, and technology. As international markets open up, companies will be able to capitalize on new growth opportunities, driving up stock prices and contributing to a bullish market. 3. Boosting Consumer Spending The impact of tariff reduction isn’t just limited to businesses it will also benefit consumers. Lower tariffs mean lower prices for imported goods, which in turn could increase consumer spending. When consumers pay less for products, they have more disposable income to spend on other goods and services, creating a positive cycle of economic growth. For example, the removal of tariffs on electronics and household goods would lower prices for consumers, making these products more affordable. As consumer spending increases, businesses will see higher demand for their products and services, leading to greater profits. This increase in consumer demand will likely boost stock prices, as companies benefiting from higher sales will experience improved earnings. 4. Restoring Investor Confidence Trade wars and tariffs have created a climate of uncertainty for investors, especially during the Trump administration’s trade negotiations. The removal or reduction of tariffs would signal to investors that the trade environment is becoming more stable and predictable. This could encourage more capital inflow into the U.S. market, leading to higher stock prices and increased investment in both U.S. businesses and the broader economy. Investor confidence is critical for stock market growth. When investors feel that the economic environment is stable, they are more likely to take risks, invest in growth sectors, and drive up stock prices. With the uncertainty surrounding tariffs potentially lifted, the stock market could see a resurgence in investor interest, benefiting long-term market growth. Key Sectors That Will Benefit from Tariff Reduction While the removal of tariffs will positively impact the entire economy, certain sectors are expected to benefit the most. Let’s take a look at the industries that could see the biggest gains in 2026 as a result of tariff reductions. 1. Technology The tech sector is one of the largest beneficiaries of tariff reductions. Many tech companies rely on overseas manufacturers for components and materials, and tariffs have inflated the cost of these goods. By reducing or eliminating tariffs on imported tech products, companies like Apple, Intel, and Microsoft could lower their production costs and improve profitability. As a result, these companies could see a boost in their stock prices, driving overall market growth. 2. Manufacturing Manufacturing industries that rely on imported raw materials, machinery, and components will also benefit significantly from tariff reductions. Sectors such as automotive manufacturing, machinery, and heavy equipment could experience a surge in demand as production costs fall and companies increase their output to meet consumer needs. This could lead to higher profits and, consequently, rising stock prices. 3. Agriculture U.S. agricultural exports have been heavily impacted by tariffs, particularly on products like soybeans and pork. With the removal of trade barriers, farmers and agricultural companies will likely see increased demand for their products in international markets. As global demand for U.S. agricultural exports grows, the agricultural sector will benefit, and stock prices in this sector could rise. 4. Retail and Consumer Goods Retailers and consumer goods companies, which often import products from overseas, would benefit from lower tariffs. By passing savings onto consumers, retailers could increase demand for their products, driving higher sales and profits. This increase in

How Trump’s Tariffs Could Shape the U.S. Economy in 2026 and Boost the Stock Market Read Post »